exempt-interest dividends wealthfront|1099 div exempt interest dividends : Cebu Dividends from US Treasury ETFs are typically exempt from state tax, which can be especially valuable if you live in a higher tax state like California. The . 27 de jun. de 2023 · Evereste é um filme baseado em uma tragédia real ocorrida no ano de 1996 e, se você nunca viu este filme, assista hoje mesmo na Star+! . O MasterDica é um site, onde os assinantes dos principais serviços de streaming, ficam ligados nas novidades, lançamentos, dicas e remoções dos catálogos. O site não possui nenhum tipo de vínculo .

0 · what are exempt interest dividends on 1099

1 · wealthfront tax exempt dividends state

2 · tax exempt dividends by state

3 · exempt interest dividends by state

4 · box 12 exempt interest dividends

5 · More

6 · 1099 div exempt interest dividends

7 · 1099 div exclusion percentage

8 · 1099 div box 12 exempt interest dividends

O Atlético-MG recebe o Corinthians, neste sábado, às 18h30 .

exempt-interest dividends wealthfront*******In the Dividends and Distributions section of your Form 1099, you may have a value in Box 12: “Exempt-interest dividends.” This value represents dividends received from ETFs like MUB, which hold a broad range of U.S. municipal bonds that pay federal . I have exempt-interest dividends from wealthfront that I have to report. Box 11 in 1099-DIV shows a $ amount, but I don't know how to split that between .★ How do I address “exempt-interest dividends” in my tax return or tax software? ★ Cost basis and sale proceeds amount on Form 1099. How do I change the tax year for an IRA .

Dividends from US Treasury ETFs are typically exempt from state tax, which can be especially valuable if you live in a higher tax state like California. The .If my Wealthfront 1099-DIV has $100 in exempt-interest dividends (box 12) out of which $20 is from NY muni bonds and $80 is from other states' bonds, do I add the $80 in my .

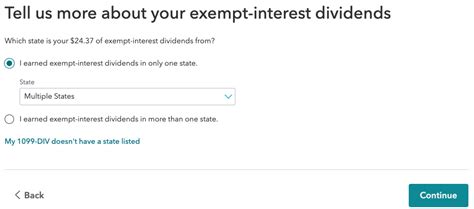

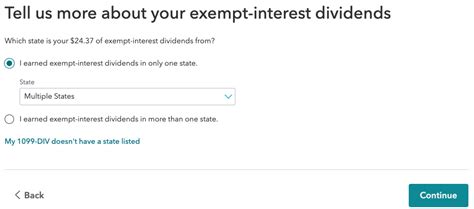

exempt-interest dividends wealthfront After importing your data, you may be prompted by TurboTax to “Tell Us More About Your Exempt Dividends.” At the State prompt, select “Multiple States” at .Exempt interest dividends from mutual funds aren’t taxable, but you should report them on your return if you’re required to file. Dividends exempt from interest might be subject to Alternative Minimum Tax (AMT). Some states do not tax exempt-interest dividends earned outside the state or have no personal income tax, in which case choosing “Multiple States” makes .Did you get a "consolidated 1099" (or words to that effect - typically includes 1099-INT, 1099-DIV, 1099-B) from Wealthfront? Often there will be a listing of the percentages by .

So it looks like you earned dividend income from that vanguard tax exempt municipal bond fund. Say you had $10 in total interest income from this fund. All $10 is free of federal income tax, HOWEVER, that $10 is still typically taxed at the state level. For background, the vanguard municipal fund consists of bonds from states across the nation. Exempt-Interest Dividend: A distribution from a mutual fund that is not subject to income tax. Exempt-interest dividends are often associated with mutual funds that invest in municipal bonds .exempt-interest dividends wealthfront 1099 div exempt interest dividends Exempt-Interest Dividend: A distribution from a mutual fund that is not subject to income tax. Exempt-interest dividends are often associated with mutual funds that invest in municipal bonds . Found a good answer from WealthFront: Because the underlying bonds that result in these dividends represent a wide range of U.S. states and municipalities, most clients select the option for “Multiple States” and do not select the option for “I earned exempt-interest dividends in more than one state: [Select the FIRST option, then use .

Wealthfront is offering an automatic portfolio just for bonds in response to surging interest in fixed income. Tax benefits from Treasuries and higher yields from corporates. Two birds, one portfolio. With an expert-built portfolio, you’ll benefit from the diversification of four different types of bond ETFs, from tax-advantaged Treasury .

Often there will be a listing of the percentages by state for exempt interest in the funds that generated income for you. When present, this is usually at the end of the document, in the "details not reported to the IRS" section. Topic Author. yurtdweller. Posts: 17.Exempt interest dividends are reported to a taxpayer on Form 1099-DIV, whether or not it’s subject to AMT. More Help with Taxable and Tax Exempt Interest Dividends Don’t do it alone! For guidance on who pays interest dividends—and how much—contact a tax .

Tax-exempt interest from other states. I live in NY. If my Wealthfront 1099-DIV has $100 in exempt-interest dividends (box 12) out of which $20 is from NY muni bonds and $80 is from other states' bonds, do I add the $80 in my NY tax filing (IT201 line 20)? I'd think yes, but Turbotax does not count it, even though I faithfully put in the .

Wealthfront answers this within their Help Center: How do I address “exempt-interest dividends” in my tax return or tax software? Reply reply A_pinkk • Thank you! Reply reply More replies [deleted] • Comment deleted by user Reply reply • .1099 div exempt interest dividendsThis is roughly half of the expected volatility for the lowest risk versions of our Classic and Socially Responsible Automated Investing Account portfolios, which are designed for long-term investment and wealth accumulation. This white paper will discuss the methodology we use to construct our Automated Bond portfolios. You can either report the entire amount as taxable in your state in the Tell us more about your exempt-interest dividends by selecting I earned exempt-interest dividends in more than one state. Then scroll all the way to the bottom of the list and select multiple states and put in the entire Box 11 exempt-interest dividend amount.

Here are eight ways you can get ready for Tax Day, whether you’re working with an accountant or using tax preparation software like TurboTax. 1. Mark your calendar. Highlight April 18, 2023 on your calendar before you do anything else. This is the date by which you must either file your tax return or Form 4868 to get a tax extension.My box 12: 12- Exempt-interest dividends (includes line 13) 306.46. On a page titled "Schedule of Management Fees". Total Tax-Exempt Resident State and US Possessions* 0.00. Total Tax-Exempt Non-Resident State* .

Per TurboTax: Your federal tax-exempt interest automatically transfers to your Connecticut return. In rare situations, however, an addition to Connecticut income is required for any interest or dividend income on obligations or securities of any authority, commission, or instrumentality of the U.S. which federal law exempts from federal . To enter exempt-interest dividends from Form 1099-DIV, box 12: Go to the Screen 12, Dividend Income (1099-DIV). Scroll down to the Tax-exempt Interest subsection. Enter the amount in the field Total municipal bonds. This amount will flow to Form 1040, line 2a per the IRS instructions for Form 1040. You must sign in to vote. . For individual, joint, and trust Cash Accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the previous calendar year or received $600 or more in awards. Most likely this form will be available on January 31st. We'll email you as soon as it is available.

Page 14 of 22 Wealthfront Brokerage LLC Account 8W13DVPK Detail for Dividends and Distributions 2022 02/08/2023 This section of your tax information statement contains the payment level detail of your taxable dividends, capital gains distributions, Section 199A dividends, exempt-interest dividends, nondividend distributions and .

Question about Exempt Interest Dividends. Question? I'm helping a 90-year-old relative with her taxes on Turbo. One thing I can't figure out is, she has a 1099-DIV and on line 12 it says she had Exempt Interest Dividends of $20,901, which matches her statement. When I enter it in the correct space on Turbo, her tax liability goes way up.

Box 12. Exempt-Interest Dividends Enter exempt-interest dividends from a mutual fund or other RIC. Include specified private activity bond interest dividends in box 13 and in the total for box 12. See the instructions for box 13 next.

Resultado da Veja as calorias e outras informações nutricionais na busca de alimentos do Vitat . Bolo com glacê e recheio. Medida. Quantidade. Calcular. Tabela Nutricional % VD (*) Calorias (valor energético) 0: kcal0.00 %Carboidratos líquidos: 0: g- Carboidratos: 0: g0.00 .

exempt-interest dividends wealthfront|1099 div exempt interest dividends